Email #1

Subject line: Here’s your free report

Preview: How to wipe out a R50 000 loan in 17 months less time than most people ever do

Hi there…

It’s William Tsedi here. My driving passion is to help willing people get what they truly want in their hearts of hearts.

I want to thank you for taking action and request my latest hot report on debt. It is titled “Discover the two-step way to wipe your personal loan 17 months earlier than most people.”

You may go ahead and download it HERE.

In this report you’ll learn:

- The 5-step universal formula to get rid of your debt.

- How to settle a R50 000 personal loan in 17 months earlier than normal… This can save you about R10 073,97 in fees and interests. And you’ll feel much lighter with fewer debts.

- The overlooked strategy to free up cash using your car(s)… No, you don’t have to sell your car and become a “Johnny Walker” at all.

Now, if you get value from the report I’d like to hear from you. Simply write me an email and tell me so.

Of course, if it trash, I also would like to know. Perhaps there’s a way I can improve it to help you as well.

Ok.

Tomorrow I’ll share with you a shocking statement made by the South African Reserve Bank (SARB) about your debt. In fact, you’ll see why our government WANT us to stay in debt.

I’ll also share with you what one psychologist named John B. Watson once said… And this explains why more than 10,15 million of South Africans are harassed by debt.

Until tomorrow….

To your debt-free life,

William Tsedi

P.S. Remember, tomorrow you’ll receive an email from me. Its subject line will be “Why Our Government Wants Us to Take More Debt.”

Email #2

Subject line: “Why Our Government Wants Us to Take More Debt”

Preview: The South African Reserve Bank (SARB) said in their March 2019 Quarterly Bulletin…

Hi there…

It’s William Tsedi here. My driving passion is to help willing people get what they truly want in their hearts of hearts.

As I promised you yesterday I am about to share with you some insider information that proves our government likes it when we are debt slaves.

You see, I was doing some intensive research on debt when I accidentally discovered this information. As I was progressing with my little research I bumped into a document called March 2019 Quarterly Bulletin written by the South African Reserve Bank (SARB).

I have a confession to make here. I had never, in my life, seen this kind of a document before. Perhaps I’m ignorant. Maybe these two diplomas and certificates I’ve gotten in my 42 year life did not prepare me for this.

Anyway.

As I paged through this document, I found this astonishing and shocking statement:

“A sustained improvement in consumer demand and business confidence is needed to boost corporate demand for credit. Encouragingly, credit extension to the household sector inched higher from 3,7% in January 2018 to 5,7% in December and grew by 4,6% on average in 2018 compared to only 2,6% in 2017 and 2,3% in 2016.”

Do you see what I mean when I say our government wants us to take more debt?

You see this statement angered me so much that I began digging deeper to create a picture of this debt issue for our people.

Do you know there’s a media company that has at least 5 websites that receives millions and millions of views per month? And these websites are where financial institutions get us from.

At the same time, these websites give us financial information that may not necessarily be the truth… And because we are blinded to believe them, we take their advice.

Just look what this information is doing to us! Over 10,15 million of our people are stuck in debt and have no idea how to escape.

Take a look at this statistic by SARB:

“Household debt as a percentage of nominal disposable income edged higher from 71,8% in the third quarter of 2018 to 72,7% in the fourth quarter, as the quarter-on-quarter increase in household debt exceeded that in disposable income.”

Whew!

That was a long sentence, isn’t it? Do you get the essence of what it means? I battled a bit with it too. Here’s my take on what it means:

A Home in South Africa Currently Spends 72,7% of

Its After-Tax Money On Debt Repayment

That means from your every R100 hard-earned after tax cash you remain with R27,70 to live on and the rest you pay your debts.

I obviously don’t know if your situation is like this. But do check.

Anyway.

All this information means is this. Most South Africans work very hard and do so primarily for the government and the financial institutions.

But how did we get into this situation?

I’ll not get into this now since this email is already long. So my next email will be called “How We Got into this Debt Trap. And How to Get Out”

Until tomorrow…

To Your Debt-Free Life,

William Tsedi

P.S. Remember to look out for email with the subject “How We Got into this Debt Trap. And How to Get Out”

P.P.S. WE love sharing the good things, don’t we? Why not share this message with your friends and family who can benefit from it. Go ahead and do that. They’ll certainly thank you.

Email #3

Subject line: How We Got into this Debt Trap. And How to Get Out

Preview: This quote by psychologist John B. Watson provides the clue…

Hi there…

It’s William Tsedi here. My driving passion is to help willing people get what they truly want in their hearts of hearts.

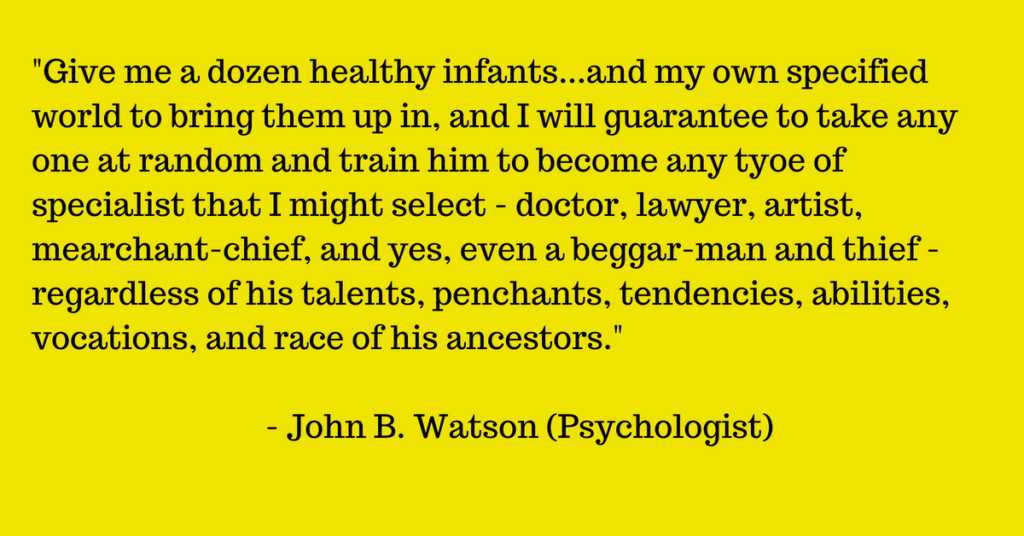

As I promised you yesterday I’m about to deliver. Let’s start by looking at one prominent psychologist once said before we dig deep into this issue…

This guy is simply saying an infant can be turned into anything one wishes… And this is what we go through from birth. We are taken through (knowingly or unknowingly) a process called conditioning (or programming like a computer).

And the tool that is used more often is called information. Yes, information… For most of us this information comes from:

- Our parents.

- Our teachers.

- Neighbours

- Religious leaders.

- And the big one is the media (newspapers, radio, magazines, television, etc)

This is where we get “trained” about money. Yet, it is estimated that 95% of the people in South Africa retire poor. So, for every 100 people you meet, chances are 95 are poor.

So, the information we consume about money and debt is what got us where we are today.

The big question is… What information are we sharing with our kids about money?

It is this reason and our debt situation that pushed me to work on a course called How to Develop Financially Savvy Kids.

How Do We Get Out of This Debt Trap?

Actually it is simple. But you will have to do it yourself. But with the guidance of someone who knows how the conditioning process works.

I’m fortunate that in the last five years (almost daily), I’ve been fascinated by how we humans work. And have become “psychologist” of some sort.

The first thing I’ve discovered you and I must do to get out of trap, is to realise we are in one.

Secondly, make a decision to come out.

What Is a Decision?

Simply, a decision means making a choice. That is, cutting off all other alternatives except the one that is important to you.

So, to come out of debt, you need to just begin with….

- Realising you are in serious trouble.

- Making a committed decision to come out.

That’s all there is to it.

But many people usually find it hard to make committed decisions to come out of debt. So something else is necessary.

That’s what I’ll talk about in my next email. The subject of the email will be “The Essential Step to Attain a Debt-Free Life.”

Watch-out for that email tomorrow.

To Your Debt-Free Life,

William Tsedi

P.S. This next step is why a huge number of people never finish the debt consolidation process. And debt counsellors are unlikely to help such people because that’s how they earn money…And in some cases certain debt counsellors must please credit providers.

So, you as the consumer are hit from both sides. What is it that debt counsellors do that you cannot do by yourself?

P.P.S. We love sharing the good things, don’t we? Why not share this message with your friends and family who can benefit from it. Go ahead and do that. They’ll certainly thank you.

Email #4

Subject line: The Essential Step to Attain a Debt-free Life

Preview: Most of people who are in debt, find it very hard to come out. Why? Here’s the answer…

Hi there

It’s William Tsedi here. My driving passion is to help willing people get what they truly want in their hearts of hearts.

Most people who are in debt find it hard to come out. Why?

Here’s the answer.

They lack the right knowledge and the right information about finances. For example, most people don’t know how financial institutions calculate how much they’ll pay for a loan.

Also, they don’t know that actually banks and other financial institutions actually own no money.

How about the fact that government wants us to get and stay in debt? I think we should wonder what the government stands to benefit by us being in debt…

Do you think the government would really help us get out of debt? I doubt. Otherwise it would have happened a long time ago.

It’s very likely the guys who are running the government are themselves trapped in debt, irrespective of how much they earn.

It’s now apparent that to get out of debt and stay debt-free, you’ll need uncensored information….This is the type of information that is not contaminated and is not hard to understand.

One more important thing is this.

You’ll need to tweak the way you see things, especially money. And one step to take is starting to mingle with the right people. Why?

The Bible tells us in Proverbs, “As a man thinketh in his heart, so is he.” So, your deep thoughts have made you the person you are today (as we said in one of the previous emails).

To help you begin this process (if you’ve not already done so), I suggest you read a very small book called As a Man Thinketh by James Allen. It will help you realise some things about you that you may have never known.

I’m adding a link here to download this little book free. And there is no need for your name and email address. The link is below:

As A Man Thinketh

Lastly, to help you make this minor adjustment (with big improvements) in your life, I’ve decided to extend an opportunity to you….

For the next 48 hours I’m offering you an opportunity to wipe out all your debt faster than most people ever do. Click HERE for full details on how it works.

If you are really fed up with your annoying debt, go ahead and click here.

To Your Debt-free Life,

William Tsedi

P.S. Tomorrow I’ll send you the last email of this series.

P.P.S. We love sharing the good things, don’t we? Why not share this message with your friends and family who can benefit from it. Go ahead and do that. They’ll certainly thank you.